This time of the year is the time when gardeners are consider the seed purchases they will make for their backyard. Taking that to a scale where you may have hundreds, even thousands of acres to plant and your family’s income is dependent on it and you can imagine it is both exciting and stressful for farmers. Looking at various market forces at play, the National Cotton Council says its farmer members intend to plant 14.5 million acres this spring — that’s an increase of almost 3 percent from acres planted to my favorite fiber in 2018. The NCC issued the report from the 2019 annual cotton planting intentions survey this morning helping us understand the big picture.

This time of the year is the time when gardeners are consider the seed purchases they will make for their backyard. Taking that to a scale where you may have hundreds, even thousands of acres to plant and your family’s income is dependent on it and you can imagine it is both exciting and stressful for farmers. Looking at various market forces at play, the National Cotton Council says its farmer members intend to plant 14.5 million acres this spring — that’s an increase of almost 3 percent from acres planted to my favorite fiber in 2018. The NCC issued the report from the 2019 annual cotton planting intentions survey this morning helping us understand the big picture.

This is a long post but I made a really quick version of it for social media. Will post that audio/video at the bottom of the post so feel to drop down there for the highlights.

Breakdown of Pima & Upland

We’ve talked about Pima cotton on the blog several times, and when you look at the numbers anticipated to be planted. it definitely draws the eye. Pima cotton requires the longer season and is generally planted in the western US. It is expected to reach 264,000 acres in 2019 which is an increase of more than 6 percent. The fiber from these acres are slotted for premium items like luxury sheets and my favorite t-shirts!

Most U.S. farmers plant what we call upland cotton and that’s where the bigger numbers come in with 14.2 million acres expected in 2019. This cotton will vary in quality so the fiber testing labs will run testing that provides detailed fiber quality information on each bale. That way textile manufacturers making jeans, towels, socks and the people making other items like mattress batting can buy the upland qualities and quantities they are interested in.

Factors Driving Farmer Intentions

There are a number of factors farmers take into account when choosing what crops to plant on their farms. That’s definitely the case as farmers were reviewing cropping options this winter. The Cotton Council’s release keys in on a few factors that were especially important as farmers looked at how much cotton to plant in 2019.

Understanding Cotton Availability

The planted acres are one piece of availability of cotton, but one of the Cotton Council’s experts, Dr. Jody Campiche, vice president, Economics & Policy Analysis, pointed out it isn’t the only one. “Ultimately, weather, insect pressures and agronomic conditions play a significant role in determining crop size.”

She pointed out those weather conditions can lead farmers to leave the crop unharvested or even plowed under — a practice the industry calls abandonment. Campiche assumed abandonment of approximately 10 percent of the U.S. acres which puts the estimate for harvest at 13.0 million acres. Figuring that at the with the average U.S. yield per harvested acre of 840 pounds will result in 22.7 million bales of cotton (that could make a lot of jeans)! The vast majority expected to be upland bales (21.9 million) and 782,000 ELS bales.

Prices for Various Crops

Campiche noted, “History has shown that U.S. farmers respond to relative prices when making planting decisions. The cotton-to-corn price ratio is lower than in 2018 due to higher corn prices as compared to last year. The cotton-to-soybean price ratio is higher than in 2018 due to lower soybean prices. A price ratio increase generally indicates an increase in cotton acreage.

“For the 2019 crop year, many producers have indicated a desire to reduce soybean acres due to low returns in 2018. As a result, corn is expected to provide the strongest competition for cotton acres in 2019.”

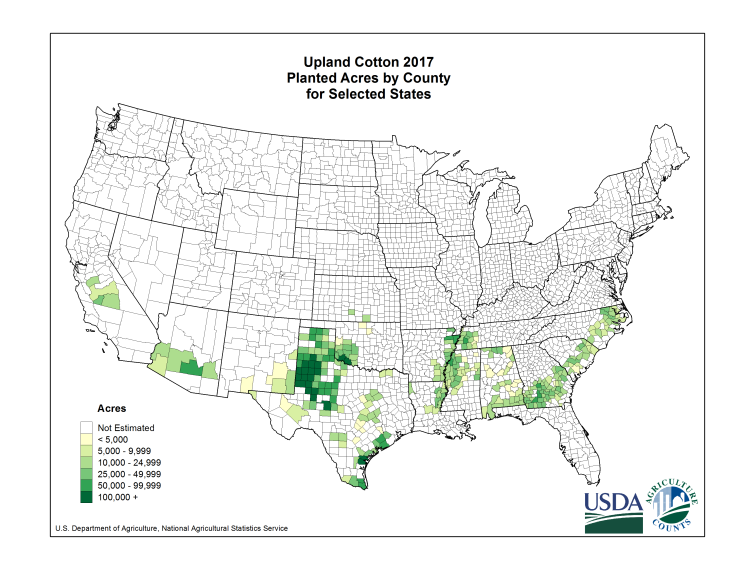

Where will cotton be planted in 2019?

This USDA map from 2017 shows what states in the US plant cotton. The darker colors signify higher numbers of acres. And while the numbers change annually, the trend for the past several years in the Southeast and Mid-South have been fewer acres than Texas which became a major force in the crop in the past two decades as new technology enabled farmers to manage some of the environmental risks.

The Southest Reduces

The survey showed that Southeast respondents anticipate decreasing cotton acres planted by 2.6 percent which brings the region’s upland area to 2.8 million acres. Two states anticipate increases in cotton this spring:

- North Carolina will show a modest increase in cotton and corn and ‘other crops’ are expected to be up too, but soybean and wheat acreage is likely to fall.

- Virginia farmers epect to plant 3.5 percent more as they shift from soybeans and other crops.

The other states in the Southeast showed expected reductions in the survey.

- Alabama is expecting a modest drop of 0.6 percent less cotton acreage and will also be reducing plantings of corn, wheat, soybeans, and ‘other crops’.

- Florida farmers are thinking shifts will go toward ‘other crops’, like peanuts.

- Georgia expects cotton acreage to drop by 3.6 percent as frowers plant more corn and ‘other crops’ including peanuts.

- South Carolina expects the largets decline at 5.4 percent, while corn and soybean acreage is expected to increase. Cotton acreage is expected to increase by 3.5 percent in Virginia as acreage moves away from soybeans and ‘other crops’.

The Mid-South Sees Increased Potential Returns

Farmers in the Mid-South region have become increasingly flexible taking advantage of various market signals annually. For 2019, the relative prices and potential returns seem to be leading to higher cotton acres — increasing by 13.6 percent to 2.3 million acres planted with increases in every state! The majority of the shift will come as farmers plant fewer soybeans.

Here’s the state-by-state farmer expectations from the survey:

- Arkansas producers intend to plant 14.4 percent more cotton acreage, as well as increase corn area while reducing soybeans and ‘other crops.’

- Louisiana shows the largest gains with farmers reporting expectations of 22.2 percent more cotton acreage in 2019. Both corn & soybeans will see losses

- Mississippi (my home for more than a decade) is expected to increase cotton area by 18.4 percent as soybean acreas and those planted to other crops drop.

- Missouri (current home state) seemed to have more farmers planting cotton for the past few years & growers expect to increase cotton acres by 6.9 percent while planting less soybeans.

- Tennessee (really home, that’s where mom is) will plant less soybeans and wheat and 5.9 percent more cotton. a

Cotton Up in the Southwest

Farmers in the Southwest plant significantly more than the rest of the Cotton Belt, and they are increasing along with others. This region reports intentions of planting 8.8 million cotton acres, a 2.2 percent increase with all three states contributing to the rise:

- Kansas farmers indicated plans to plant 3.4 percent more cotton acres.

- Oklahoma will see a small 1.0 percent increase in cotton acreage.

- Texas acreage is expected to increase by 2.3 percent.

Small but Mighty Far West Up too

The Far West is where Pima acres come in and there appear to be some increases in upland and Pima for the region. The anticipated area is 86,000 upland cotton acres to be planted, increasing 2.9 percent from 2018. The increases in cotton acres are expected in Arizona and California whereas New Mexico anticipates lower planting. The modest 1.0 increase in upland cotton for Arizona is set next to a leap in California as growers intend to plant 14.4 percent more cotton with increases in upland and ELS / Pima.

Hopeful Despite a Tough 2018

I haven’t talked about it too much, but the hravest season was a realy rough one for many. I had friends who have typcially wrapped harvest before Thanksgiving still in the field at Christmas. The weather delays meant setbacks on prices due to yield and quality losses which made 2018 a tough one for many financially. The Cotton Council points out that “production costs remain high, and unless producers have good yields, current prices may not be enough to cover all production expenses. Despite these challenges, cotton is still the better alternative for many growers. Based on current prices, projected cotton returns are currently more favorable than some competing commodities. Improved seed varieties continue to increase yield potential and improve cotton’s profitability. In the West, expected water availability may be influencing cotton acreage decisions.”

Of course, all these numbers are subject to change as farmers stay plugged in on the various market forces at play.